The question of how to pay for infrastructure is not a new one – it has been around for a millennium.

In times past, roads and bridges were built by kings or empires primarily to facilitate military necessities.

As examined in previous blog posts, infrastructure tends to be built in times of national prosperity, to assist with the growth of commerce, and in times of national emergency or threat for military security or movement reasons.

When economies are weak, which happens periodically due to business cycles, changes in terms of trade, or changes in population distribution or demographics – the questions of how to manage and pay for infrastructure become much more pressing and vital.

As outlined in my June Ingenium Conference Paper, whilst New Zealand is currently doing well in world terms, it faces a sustained period of fiscal constraint, and local authorities have stressed all funding sources for infrastructure.

New Zealand local authorities manage about half of the nation’s public infrastructure. They have four primary funding sources – government grants (mainly those from the National Land Transport Programme), Land Taxes, Loans, and Capital contributions from developments.

Politically and practically, all of these funding sources are under pressure, and in the case of loans – nearing prudent limits.

This issue of how to fund infrastructure is not only faced by New Zealand. It is a familiar theme in many countries.

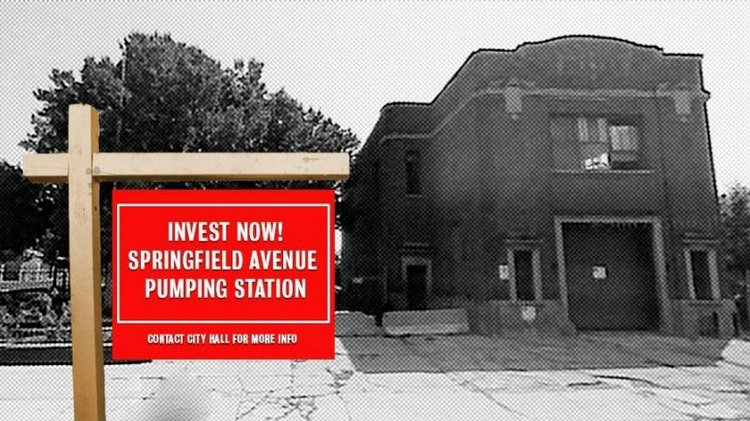

I came across this article about the Chicago Infrastructure Trust and found it interesting.

To quote the article:

Governments across Europe, Canada, and Australia have long turned to the private sector to help finance public assets, and even in the U.S., more places are dabbling in it. But it’s still rare for cities to take the lead. And no place, at least in this country, has tried what Chicago is launching this year: A nonprofit agency devoted to tapping private capital through structured financing while retaining public ownership, both for big-ticket items but also for workaday municipal infrastructure.

This article has been drawn from the Next American City website, and both sites are worth reading.

What I like about the experiment Chicago is running is that they seek to involve private investment in infrastructure without the need to privatise the assets – they are seeking to retain public ownership of infrastructure.

It seems an idea worth discussing and thinking about amongst infrastructure management professionals.

One thing is sure – the issue of how to pay for infrastructure is not going away.